*Updated October, 28 2022

The COVID-19 pandemic was often characterized as being “bad for the economy" but interestingly enough, not all sectors of the economy suffered during the pandemic. Unsurprisingly, online ventures positively thrived. For instance, with everyone who had the privilege of moving their work to their home, investments in remote working platforms and video calling services increased. In fact, Zoom, the poster child of the so-called “new normal” in workplace practices, had its stock up by 400% by the end of 2020, though it dropped by 45% the following year.

The fintech industry also witnessed incredible growth during the pandemic. Investments in fintech in 2021 nearly doubled from 2020. Forty-two fintech unicorns were born only in the third quarter of 2021, with a total of 200 new unicorns for the whole year.

What’s more, fintech startups accounted for one third of all new unicorns in the last quarter of 2021. But is this the same sort of fintech industry we’d had for years, just growing at an increased rate? Or is fintech setting course in a new direction, one that addresses problems that previously existed, but were made more evident during these trying times?

Probably a bit of both. Undoubtedly, COVID-19 shed new light on the existing problematic infrastructures, making old cracks more visible - and more urgent - than before. Let’s delve into the subject and see how the pandemic has shaped the future of fintech growth and development.

The global landscape of fintech development during the pandemic

We’ve already established that investments in fintech as much as doubled in 2021 compared to 2020, though the accelerated rise of fintechs started as early as 2020, in step with the spread of the pandemic. There have been a fair bit of new fintechs in emerging markets and developing economies, not just in long-established markets like ones in the US and western Euro'pe.

In fact, 2021 reports show that while the US is still the leader in global fintech deals with a share of 38%, it’s closely followed by one of the fastest-growing economies in the world - Asia, with a share of 26%. Only Southeast Asia is home to 35 fintech unicorns. We’ll expand more on this later, but for now, it’s important to recognize that fintech has experienced this boom because it’s a sector that’s being developed all over the world, though possibly in different ways.

In regional terms, the Middle East and North Africa witnessed the highest fintech growth during 2020, both up by 40%. In second place were sub-Saharan Africa and North America, with an estimated 21% growth in fintech. Furthermore, India has seen a lot of investments in fintech since the last quarter of 2019, the start of COVID.

In regional terms, the Middle East and North Africa witnessed the highest fintech growth during 2020, both up by 40%. In second place were sub-Saharan Africa and North America, with an estimated 21% growth in fintech. Furthermore, India has seen a lot of investments in fintech since the last quarter of 2019, the start of COVID.

Then, in the first half of 2021 alone, fintech investments reached $2 billion, nearly matching the total investments of the entire 2020. Singapore is another quickly-growing fintech startup hub that saw a surge in fintech investments in Q4 of 2019, and in 2021. The biggest fintech deal here went to an eWallet company, which indicates that fintech’s headed towards addressing problems experienced by the end customer. This goes to show that the market is catching up with the demand, or rather, beginning to truly understand what people need.

How COVID-19 changed fintech development

In its simplest form, lockdowns and similar restrictions of movement in the early COVID days meant that people needed access to financial services from their homes. In light of that, it’s no surprise that the fintech sub-sectors that experienced the most growth and underwent notable innovative changes were digital lending, digital payments, and digital capital raising. In fact, these three sub-sectors accounted for over 50% of correspondents in a fintech market assessment study during COVID that totaled 1,385 fintech firms from 169 countries.

The study tracked fintech during 2020 and found that most fintech firms were implementing changes in response to COVID-19. As much as 60% of correspondents in the study reported that they’ve launched new products or services in response to the pandemic, and 32% reported that they had plans to deploy such offerings.

For instance, 38% of digital payment firms worked on developing and launching additional payment channels for their clients, 35% of digital lending companies launched value-added non-financial services like information services, and 35% of digital capital raising hosted COVID-related funding campaigns.

Some of the main changes that fintechs implemented include “fee or commission reductions and waivers, changes to onboarding criteria, and payment easements.” About 36% of digital payment companies introduced reduced fees and reductions, 53% of digital lending firms modified the criteria for qualification and onboarding, and 49% implemented payment easements.

In other words, the market responded to the state of affairs.

Interest vs. action in COVID relief campaigns

The reductions and waivers of fees allude to another important trend in pandemic-days fintech– COVID relief campaigns. The study discovered that a high number of fintech firms expressed eagerness to aid those most affected by the economic downturn by partaking in COVID-19 relief measures and schemes. More than a third of fintech respondents said they’d participate in such measures, especially in partnerships with industry-led relief, government-led match-funding campaigns, and government-led stimulus funding for MSMEs (micro, small, and medium-sized enterprises).

However, the actual number of fintechs involved in COVID relief is much lower than that. 7% of firms joined NGO-led campaigns, and 13% were involved in government-led job retention schemes.

One thing remains certain, however: by making the socioeconomic inequalities more evident alongside the gaps in the disproportional fintech coverage - in terms of costs, services, and regions - COVID expedited the growth of fintech technologies that were aimed at addressing the needs of at-risk groups.

Cybersecurity

People were finding all sorts of new ways to adapt to the new “laws” of the pandemic, and with economic turmoil came skirting the law. So, cybercrime was on the rise from the very start of the pandemic. As early as 2020, fintech companies perceived an increased risk in cybersecurity threats.

There’s also a notable difference, in fact, in the rise of cybercrime in markets with less restrictive anti-COVID measures, such as lockdowns, and markets with more stringent measures. The perceived threat to cybersecurity by firms in high-stringency markets saw an 11% increase while their lower-stringency counterparts experienced no such increase in perception.

The most affected fintech sectors were:

- digital asset exchange with a perceived increased risk of 32%

- digital banking with a 20% perceived risk increase

- digital payment companies with a 19% risk increase

What’s more, the rise of neobanks, completely digital banks, has also shown the need for state-of-the-art cybersecurity measures, especially during this period.

And it’s not just private institutions. In some countries, for instance, governments have relaxed the regulations allowing people to open bank accounts digitally and from remote locations. However, at the same time, these governments are taking additional security measures, such as raising awareness of fraud or adding requirements to mitigate the risk of cyber threats in the process of digitizing finance.

One of the main methods of boosting cybersecurity is implementing more effective KYC (know-your-customer) and AML (anti-money-laundering) checks. This is one of the major points where AI startups intersect with the fintech industry. London-based Onfido, for instance, uses AI to match a person’s facial biometrics from a photo to the photo provided in their ID. This is meant to speed up the process but also confirm identities in a secure manner.

Why did fintech need to change?

Homebrew’s cofounder Satya Patel answered this question for Forbes:

“Financial services is one of the largest industries on the planet, but until recently, the way it operated had remained unchanged for decades… And because of that, there are huge segments of the population that are underserved or ignored by current financial services players. Fintech is changing all of that by decreasing costs, increasing access and improving experiences for financial products and services.”

A clear example of this is the astronomical rise of fintech startups in Asia. Most of these are consumer-oriented, i.e., meant to bridge the gap between an underbanked population and affordable, easily-accessible financial services.

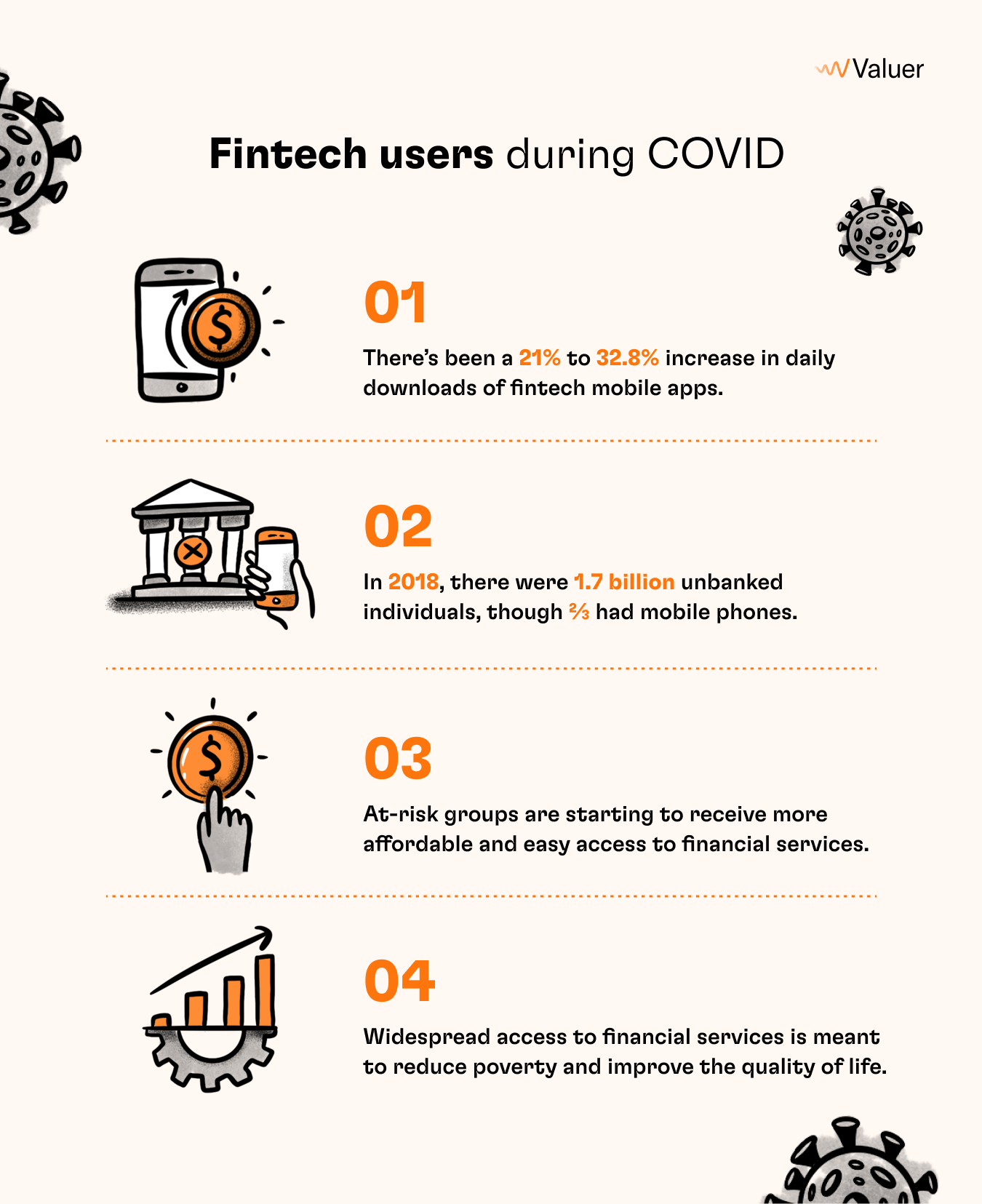

A recent study estimated an increase in daily fintech mobile app downloads by 21% to 26%. And this isn’t the only source that reports the growth of daily fintech app downloads. A study by the Swiss Finance Institute estimates an increase in daily downloads ranging from 29.2% to 32.8%. This means that daily fintech app downloads increased by a third during COVID.

People are turning to these apps to manage their finances, find alternative lenders in order to recover from economic losses caused by the pandemic, pay bills, etc.

That’s why it comes as no surprise that in addition to digital payment, lending, and capital raising fintech firms, “buy now, pay later” offerings are also on the rise in the Asia Pacific. In Indonesia alone, 44% of Fintech companies are payment service providers, as are a lot of the top fintech firms we covered in our article on Asian startups are concerned with helping end customers receive these types of financial services in an affordable and straightforward manner. For instance, we see startups matching people with lenders, platforms that provide users with useful financial information, e-wallet, and digital payment services, as well as “buy now, pay later” offerings.

What should be a focal point for the future of fintech?

In the words of Caroline Freund, the World Bank Global Director for Finance, Competitiveness and Innovation, when referring to the same study we talked about before:

“Fintech has shown its potential to close gaps in the delivery of financial services to households and firms in emerging markets and developing economies… This survey shows how the fintech industry is adapting to the pandemic and offers insights for regulators and policymakers seeking to promote innovation and reap the benefits of fintech, while managing risks to consumers, investors, financial stability, and integrity.”

In a 2018 press release, the World Bank reported 1.7 billion unbanked adults globally. But two-thirds of these adults own mobile phones, and digital technology - fintech - could provide these people with access to the financial system, and through that, accounts, wages, pensions, social benefits, etc. Fast-forward from this 2018 press release to today, and we see that COVID accelerated what was envisioned for fintech development in the first place.

Furthermore, it is the stance of the World Bank that one of the main objectives of fintech is to help at-risk categories gain access to financial tools and use these fintech instruments to reduce poverty, increase incomes, grow their resilience, and gain an overall better quality of life.

In a way, some of this is ingrained in the digital nature of fintech, as it automatically reduces the cost of using financial services. It is exactly these perks that made fintech such a strong force during the pandemic. It is also what made the sector so resilient during this period, unlike many other industries.

The future of fintech post-COVID

The digitization of finance was always bound to happen - COVID just gave it a good kick in the butt. The future of fintech development in a (semi) post-COVID world is already taking shape. For one, there’s the digitization of financial services and processes. An already high percentage of established banks find partnerships with young, agile, and innovative fintech startups key to future success. It’s the sort of partnership that benefits both sides - startups get resources while the banks, or other financial institutions, get to respond to user demands and implement changes faster.

In light of this accelerated digitization, there’s a good deal of evidence that COVID sped up the seemingly inevitable decline of cash. Contactless payment was preferred as the “cleaner” means for financial transactions during the pandemic. But a Mastercard survey found that 74% of respondents planned to continue using contactless payment even after the end of the pandemic.

In the end, with increased cybersecurity measures and a good deal of collaboration between the fintech and AI industries, financial services are likely to continue moving to the digital sphere at an accelerated pace. This is where the present and future of fintech lie.

.png?width=103&height=103&name=Untitled_Artwork%20725%20(2).png)